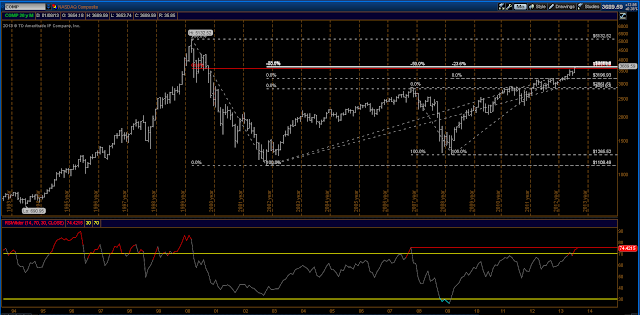

If so, could the pattern on the COMP (Nasdaq Composite), developed from 04.2010 to 11.2012 (monthly chart here, red numbers), be counted as a wave 2?

In other words, I would like to know if the EW theory allows for a corrective wave 2 to be a leading diagonal that makes higher highs and if this EW count could have any merit?