Pre-ECB ramp-up to the extreme 78.6% fib retracement of entire previous movement = Tuesday high @1383.

Disappointment at Draghi's announcement starts the sell-off.

TH opening ramp-up to 50% fib retracement (h.10:25), drawn from anchor point ECB high (validated by the 78.6% = Tuesday high).

Low of the day at -23.6% standard fib retracement of same previous 50% fib retracement = -50%fde opening gyration (TH 60m OR) = RSI/price positive divergence.

Notable (see two charts above): when, at the ramp-up opening, the ES had reached the 38.2% fib retracement of the larger possible high-to-low, the $DJI had not yet. When the $DJI reached its 38.2% fib retracement (h.10:25), ES was @50% fib retracement of the smaller proportion and that was then enough to continue lower (i.e. $DJI proportion is leading).

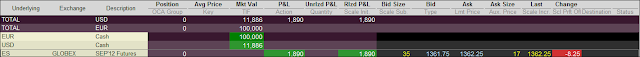

Realized P&L was €1,890.

I end the day flat.